Oregon’s Tax Disconnect Debate and the Tradeoffs Lawmakers Can’t Escape

A roughly $300 million question is forcing Oregon policymakers to confront two uncomfortable truths at the same time: families are feeling acute cost pressure right now, and long-term funding for public services ultimately depends on whether the state remains a place where businesses invest, expand, and hire.

When Congress enacted sweeping federal tax changes last year, it set the stage for a battle in Salem between those who see the changes as targeted investments to drive economic growth, and those who see them as an immediate hit to Oregon’s General Fund at a moment when budgets are already stretched.

The push to selectively disconnect Oregon’s tax code from parts of the federal changes began with a simple claim — some provisions of the federal budget bill disproportionately benefit high-income investors while leaving the state with fewer resources to address rising costs for households, schools, and social services.

That argument was advanced most clearly by public employee unions, educators, and human services advocates and became the catalyst for SB 1507.

The Revenue and Equity Argument

Supporters of disconnection warn that mirroring federal tax changes without adjustment could deepen fiscal pressure at a time when Oregon faces escalating costs in education, health care, housing, and behavioral health.

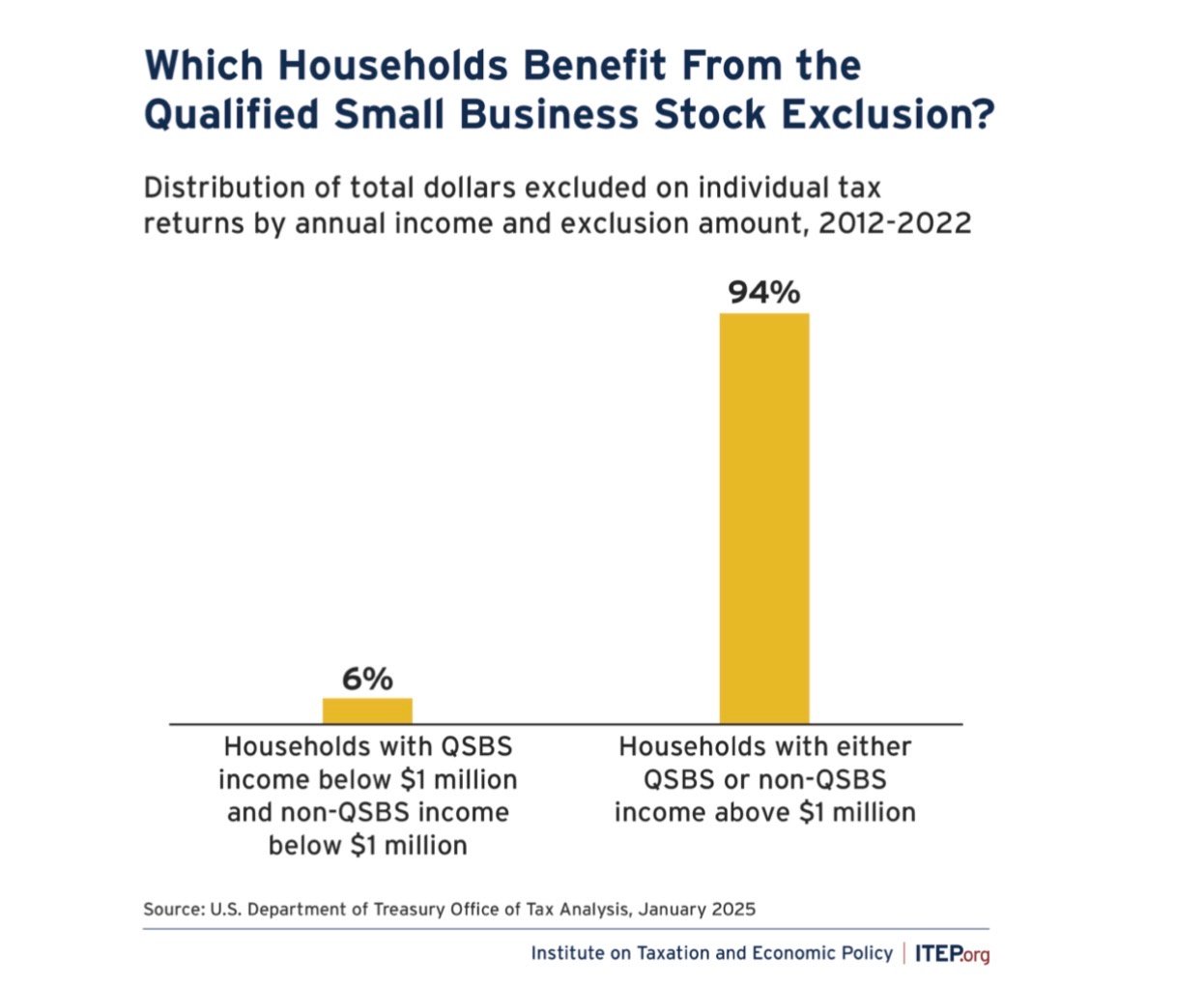

Analysis from the Oregon Center for Public Policy (OCPP) sharpened that case by focusing on the Qualified Small Business Stock (QSBS) exclusion.

Policy analysts note that nearly all QSBS tax benefits flow to households earning more than $1 million annually, shaping arguments for selective disconnection.

OCPP data show that nearly all of the QSBS tax benefit flows to households earning more than $1 million per year. Supporters of SB 1507 point to this concentration as evidence that some federal provisions are poorly targeted to Oregon’s current needs, and that selective disconnection could protect revenue without touching wages, tips, or overtime.

Teachers unions and human services organizations echoed that framing in testimony, tying potential revenue losses directly to consequences on the ground: larger class sizes, reduced access to higher education, pressure on Medicaid and behavioral health systems, and fewer supports for families already struggling with childcare and housing costs.

From this perspective, the debate is not about punishing business, but about preventing cost pressures from cascading onto households that are least able to absorb them.

The Counterargument: Investment, Jobs, and Long-Term Capacity

Business advocates responded with a different diagnosis. Their argument is that Oregon’s capacity to fund public services over time depends first on sustaining private-sector investment and job growth, especially in a competitive regional economy.

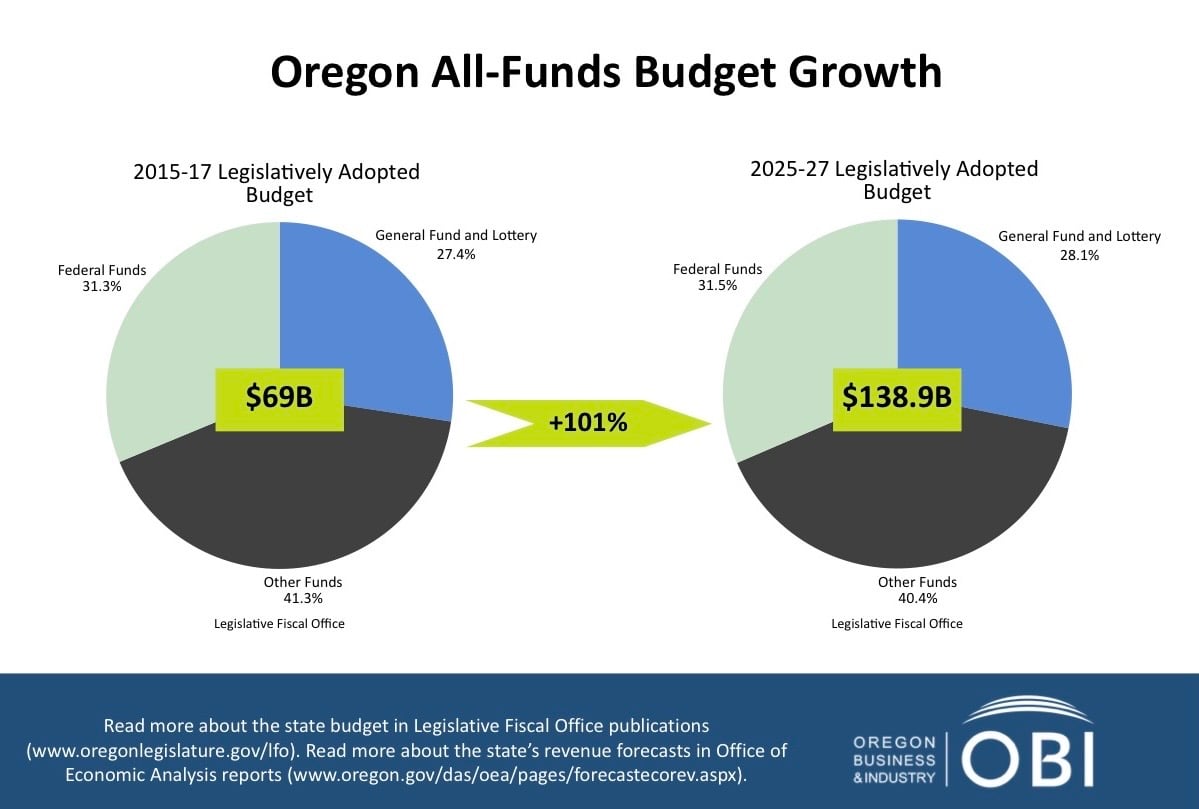

Oregon Business & Industry (OBI) and other employer groups pointed to long-term fiscal data to argue that Oregon’s challenge is not simply about insufficient revenue, but about whether the state’s economic climate supports durable growth.

Business groups point to sustained growth in Oregon’s all-funds budget as lawmakers weigh near-term revenue needs against long-term economic competitiveness.

The chart shows Oregon’s all-funds budget has grown significantly over the past decade. Business groups cite this trend to argue that policy choices should focus on expanding the tax base through investment and employment, rather than narrowing incentives that influence where capital flows.

That concern is not abstract. Salem-based Pacific Seafood, a major local employer, warned in their testimony that disconnecting from federal provisions could increase compliance complexity and administrative costs — a burden that functions as a hidden tax, particularly for smaller suppliers and vendors without large accounting departments.

Contractors and Capital-Intensive Businesses

Contractors raised similar concerns from a different angle, emphasizing how capital-intensive businesses operate under tight margins and long planning horizons.

Darrell Fuller argues that bonus depreciation helps reduce barriers to investment for small and mid-sized contractors operating on thin margins.

Darrell Fuller tied the debate to the Governor’s Prosperity Roadmap, emphasizing that tools like bonus depreciation are not abstract tax preferences, but mechanisms that allow existing businesses to survive long enough to reinvest, modernize equipment, and hire.

In that view, discouraging capital investment does not simply reduce profits, but also reshapes which businesses are able to compete and remain rooted locally.

The Political Fault Line: Timing and Jobs

Those concerns were amplified by Senate Republican Leader Bruce Starr (R-Dundee), who framed the issue through the lens of Oregon’s labor market.

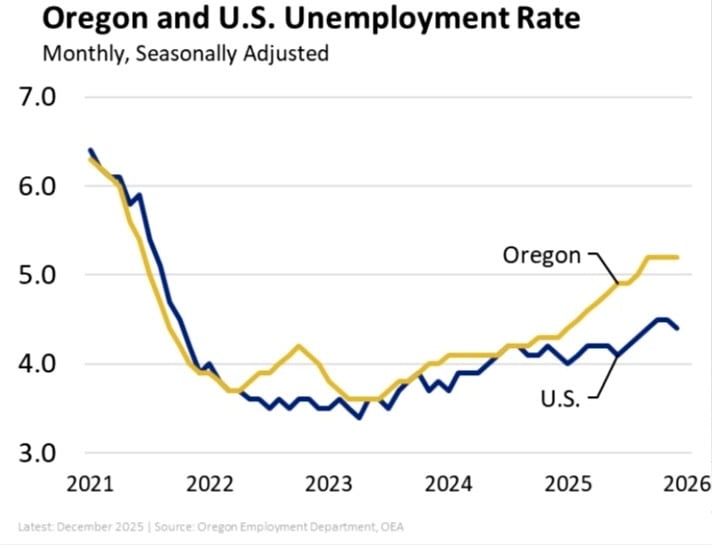

Sen. Starr frames the tax disconnect debate as a question of timing — whether discouraging investment risks slowing job growth during a fragile recovery.

Starr pointed to Oregon’s unemployment rate, which remains above the national average, and warned that dampening investment during an uneven recovery could slow hiring and wage growth.

Oregon’s unemployment rate is rising faster than the national average, widening the gap.

At this point, the core tension in the debate becomes clear. Both sides emphasize affordability and jobs, but disagree on sequencing. Should Oregon prioritize stabilizing revenue now, even if it risks discouraging investment? Or protect investment incentives to grow the economy first, accepting near-term fiscal pressure?

Broadman’s Case for Threading the Needle

Senate Finance and Revenue Chair Anthony Broadman (D-Bend) acknowledged that tension and defended the committee’s amended approach.

Broadman emphasized what the bill does not do: it does not tax tips or overtime, and it preserves alignment with federal provisions related to research and development, Section 179 expensing, and production property depreciation.

Sen. Broadman describes the challenge in striking the right balance between affordability and competitiveness.

Instead, the bill targets a narrow set of provisions while expanding the Earned Income Tax Credit, which Broadman described as one of the most effective tools for supporting low- and moderate-income working families.

At the same time, Broadman acknowledged the political reality that no solution fully satisfies either camp. The approach, by his own description, is tight and imperfect — an attempt to navigate real constraints rather than resolve them cleanly.

The Tradeoff at the Heart of the Debate

What this debate reveals is not a simple business-versus-labor divide, but two competing strategies for managing finite resources.

One side argues that sustained capital investment is the foundation of job creation, wage growth, and future revenue. The other warns that without near-term revenue stability and targeted relief, households and public systems absorb harm that growth alone may not quickly repair.

The center of this debate lies not in splitting the difference, but in recognizing that economic growth and social stability are interdependent. Oregon’s challenge is to deploy limited tools where they have the greatest leverage, to encourage investment that anchors jobs locally, while ensuring tax policy does not deepen inequality or undermine essential services.

SB 1507 does not resolve that tension. But it surfaces the right question: how does Oregon chart a path that supports both the businesses that generate opportunity and the families who rely on the state’s capacity to deliver it?

That question will extend well beyond this bill during this session, and it is the one policymakers will continue to face as economic headwinds persist.